This was before COVID 19 and back in 2019 around Dec period.

It has been quite a while since mi and wife went for a date ever since our 2 daughters are born.

We planned our leave on a Friday so that we can enjoy ourselves without our kids around who are at school while we go and relax for ourselves.

Let me share with you on how the day went and perhaps it may be how you would like to spend you day as well with your spouse / friends as well.

We woke up as usual at 630 am and prepare our 2 daughters for school. By the time we went out of the house, it was 7:30 am. Off we go hand in hand with our 2 lovely daughters. After putting them in school, we were off to Sentosa.

I didn't book any tickets as we go into Sentosa as i figured if there's any online deal, i will just check on the internet when i reach the ticketing office. We compared and checked the pricing as per internet. The ticketing officer lady was nice to point out to us that we can get a better deal by purchasing the 90 tokens as we were going for the Trick Eye and SEA Aquarium. On top of that we get 25% discount as locals. Do purchase from the ticketing counter 😊 Here's the link below.

https://www.sentosa.com.sg/en/deals/fun-pass/

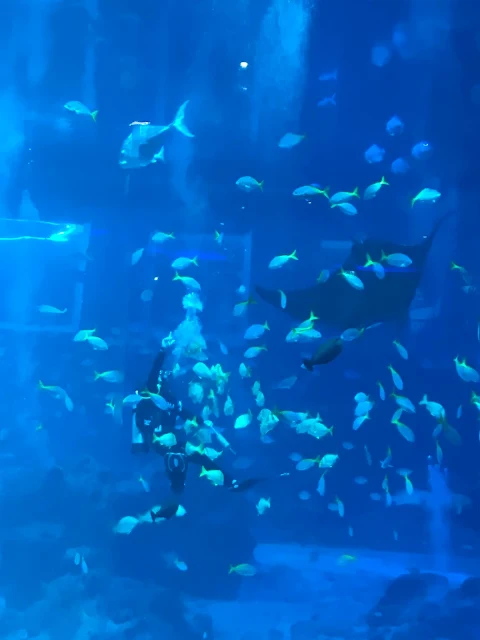

We took our breakfast at Vivo City coffeeshop before going in on to the tram Sentosa Express monorail. After which we alight at the resorts world station and walk towards our first destination at SEA Aquarium. Here are below some of the photos we took. There were so many interesting creatures and not to mention the diver that is swimming around. There was also a Mascot which we manage to have a picture taken.

Our First stop SEA Aquarium.

Outing hours : 1.5 hours

Outing experience : 3.5 stars out of 5 stars.

I will give another 1 star if there are interactive games to play in understanding about the creatures and diver not just sight seeing. It could be a talk and show around with a guide so that it becomes more interactive. This will greatly enhance the experience for people.

From there we exit and went for our lunch before we went to Trick Eye Musuem.

There is a coffee shop nearby Trick Eye Musuem where we can eat and dine. As it was a week day there were not many people, nevertheless the food was good. I did not take any pictures of the place but you will not missed it by following the sign boards. In Sentosa you will not get lost, there are so many sign boards pointing to you the direction and they are huge.

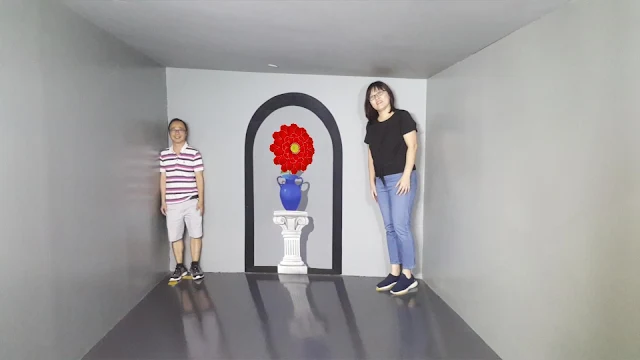

Take a look at the pictures we have taken. We really to thank the customer service guy who help to take our pictures and provided us a power bank as well as our handphone batteries were running very low.

Kudos to Trick Eye Museum people for making our experience. Thumbs up.

End of our 2nd Stop

Outing hours : 3.0 hours

Outing experience : 4.75 stars out of 5 stars