Creating a vision board is a powerful tool to help you visualize and achieve your financial goals. It serves as a daily reminder of what you want to achieve and keeps you motivated. In a vibrant and dynamic city like Singapore, where the cost of living is high and financial aspirations are significant, a financial freedom vision board can be particularly effective. This guide will take you through the process of creating a vision board specifically tailored to your financial freedom goals in Singapore.

What is a Financial Freedom Vision Board?

A financial freedom vision board is a visual representation of your financial goals and dreams. It includes images, words, and phrases that represent what financial freedom means to you. The purpose of the vision board is to keep you focused on your goals and to inspire you to take action towards achieving them.

Why Create a Financial Freedom Vision Board?

- Clarity: It helps you clarify what financial freedom means to you and identify your specific goals.

- Motivation: Seeing your goals represented visually keeps you motivated and reminds you of why you are working hard.

- Focus: It helps you stay focused on your long-term objectives, even when faced with short-term challenges.

- Positive Reinforcement: It reinforces positive thinking and helps you maintain a success-oriented mindset.

Step 1: Define Your Financial Freedom Goals

Before you start creating your vision board, it's essential to define what financial freedom means to you. Financial freedom can mean different things to different people, but it generally involves having enough savings, investments, and passive income to live comfortably without being dependent on a paycheck.

Examples of Financial Freedom Goals:

- Debt-Free Living: Paying off all your debts, including credit cards, student loans, and mortgages.

- Savings Goals: Building an emergency fund, saving for a home, or accumulating a certain amount in your savings account.

- Investment Goals: Investing in stocks, real estate, or retirement accounts to generate passive income.

- Career Goals: Starting your own business, achieving a higher salary, or transitioning to a job you love.

- Lifestyle Goals: Traveling, buying a car, or enjoying a certain standard of living without financial stress.

Write down your financial goals in specific, measurable terms. For example, instead of writing "save more money," write "save $20,000 in the next two years."

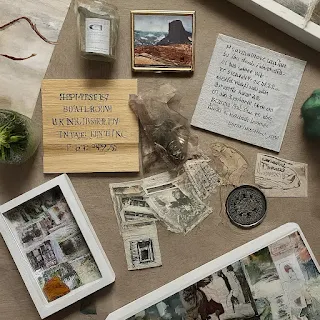

Step 2: Gather Your Materials

To create a vision board, you’ll need the following materials:

- Board: A large poster board, corkboard, or canvas.

- Magazines: Collect magazines and newspapers that you can cut images and words from.

- Printouts: Print out images or quotes from the internet that represent your goals.

- Scissors and Glue: For cutting out and sticking images onto your board.

- Markers and Pens: For writing down your goals and adding personal touches to your board.

- Decorative Items: Stickers, washi tape, and other decorative items to make your board visually appealing.

Step 3: Find Inspiration

Look for images, words, and phrases that represent your financial freedom goals. Think about what financial freedom looks like to you and how it makes you feel. Consider the following sources of inspiration:

- Financial Milestones: Images of debt-free living, savings goals, investment accounts, and passive income sources.

- Lifestyle: Pictures of the lifestyle you want to achieve, such as traveling, owning a home, or enjoying leisure activities.

- Quotes and Affirmations: Motivational quotes and affirmations that inspire you to stay focused and motivated.

- Personal Symbols: Items or symbols that have personal meaning to you and represent your journey towards financial freedom.

Step 4: Create Your Vision Board

Now that you have gathered your materials and found inspiration, it’s time to create your vision board. Follow these steps to assemble your board:

- Arrange Your Items: Lay out your images, words, and phrases on the board without gluing them down yet. Experiment with different layouts until you find one that feels right.

- Start Gluing: Once you’re satisfied with the arrangement, start gluing your items to the board. Be creative and have fun with it.

- Add Personal Touches: Use markers, pens, and decorative items to add personal touches to your board. Write down your financial goals, add motivational quotes, and decorate your board to make it uniquely yours.

- Organize by Categories: Consider organizing your vision board by categories, such as savings, investments, career, and lifestyle. This can help you stay focused on each area of your financial goals.

Step 5: Place Your Vision Board Somewhere Visible

To maximize the effectiveness of your vision board, place it somewhere you will see it daily. This could be in your bedroom, home office, or any other place where you spend a lot of time. The more you see your vision board, the more it will remind you of your goals and keep you motivated.

Step 6: Take Action Towards Your Goals

Creating a vision board is just the first step. To achieve financial freedom, you need to take consistent action towards your goals. Here are some practical steps you can take:

- Create a Budget: A budget helps you manage your money, track your spending, and ensure you are saving and investing towards your goals.

- Reduce Expenses: Look for ways to cut unnecessary expenses and save more money. This could include dining out less, cutting subscription services, or finding more affordable alternatives.

- Increase Income: Find ways to increase your income, such as taking on a side job, freelancing, or seeking a higher-paying position.

- Save and Invest: Allocate a portion of your income to savings and investments. Consider setting up automatic transfers to make this process easier.

- Stay Informed: Educate yourself about personal finance, investing, and money management. Read books, take courses, and follow financial experts.

Singapore-Specific Financial Goals and Strategies

In Singapore, achieving financial freedom may require specific strategies due to the high cost of living and unique financial landscape. Here are some Singapore-specific financial goals and strategies:

Housing:

- HDB Flats: Consider purchasing a Housing and Development Board (HDB) flat, which is more affordable than private property. Look into grants and schemes available for first-time buyers.

- Renting: If buying a home isn’t feasible yet, look for affordable rental options and save for a down payment.

Transportation:

- Public Transport: Utilize Singapore’s efficient public transportation system to save on transportation costs. Opt for an EZ-Link card for convenience and savings.

- Car Ownership: If owning a car is necessary, consider the total cost of ownership, including Certificate of Entitlement (COE), road tax, and maintenance.

Savings and Investments:

- CPF: Maximize your Central Provident Fund (CPF) contributions to benefit from government incentives and secure your retirement.

- SRS: Consider the Supplementary Retirement Scheme (SRS) for additional tax benefits and retirement savings.

- Investing: Explore investment options such as the Singapore Savings Bonds (SSB), stocks, and real estate investment trusts (REITs) for long-term growth.

Education:

- SkillsFuture: Take advantage of the SkillsFuture initiative to upgrade your skills and enhance your career prospects.

- Education Savings: Plan for your children’s education expenses by setting up an education savings plan or investing in endowment plans.

Healthcare:

- MediSave and MediShield Life: Use your CPF MediSave account and MediShield Life for healthcare expenses. Consider additional private health insurance for comprehensive coverage.

- Preventive Healthcare: Regular health screenings can prevent costly medical bills in the future. Utilize government-subsidized health services when available.

Maintaining and Updating Your Vision Board

Your vision board is a dynamic tool that should evolve as your goals and circumstances change. Here’s how to keep your vision board up-to-date:

- Review Regularly: Review your vision board regularly to ensure it still reflects your financial goals. Update it as needed to keep it relevant.

- Celebrate Achievements: When you achieve a goal, celebrate your success and add new goals to your vision board.

- Stay Flexible: Life is unpredictable, and your goals may change. Stay flexible and adjust your vision board to reflect your evolving aspirations.

Inspirational Quotes for Your Vision Board

Including motivational quotes on your vision board can provide daily inspiration. Here are some quotes to consider:

- “The best way to predict the future is to create it.” – Peter Drucker

- “Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

- “Financial freedom is available to those who learn about it and work for it.” – Robert Kiyosaki

- “Your life does not get better by chance, it gets better by change.” – Jim Rohn

- “The future belongs to those who believe in the beauty of their dreams.” – Eleanor Roosevelt

Success Stories: Singaporeans Achieving Financial Freedom

Reading about the success stories of fellow Singaporeans can be incredibly motivating. Here are a few examples:

- Mr. Tan’s Story: Mr. Tan started with a modest income but diligently saved and invested. Over the years, he built a diversified investment portfolio, paid off his home loan early, and now enjoys a comfortable retirement.

- Ms. Lim’s Journey: Ms. Lim faced significant debt after university. Through strict budgeting, side jobs, and disciplined savings, she became debt-free and started investing. She now mentors others on financial management.

- The Lee Family: The Lee family prioritized financial education for their children. By instilling good financial habits early, their children graduated with no student loans and started investing in their early twenties.

Conclusion

Creating a financial freedom vision board in Singapore is a powerful way to visualize and achieve your financial goals. By defining your goals, gathering inspiration, and taking consistent action, you can turn your vision of financial freedom into reality. Remember, the journey to financial freedom is a marathon, not a sprint. Stay motivated, stay focused, and keep working towards your goals. With time, effort, and perseverance, you can achieve financial freedom and enjoy a fulfilling life in Singapore.

No comments:

Post a Comment